The trade fair concept is alive and well, and the textile and clothing industry is clearly living it too. The recent dual exhibition, Techtextil and Texprocess in Frankfurt, proved to be an impressive showcase for the future of the textile and clothing industry. With 1,700 exhibitors from 53 countries, the event offered a comprehensive platform for innovations and trends in the technical textile industry as well as the clothing and textile processing industries.

It's a dual trade fair: Techtextil is promoted as the leading international trade fair for technical textiles. The entire industry, from fiber to finished technical textiles with a wide range of functions, is presented here. Texprocess, the leading international trade fair for the clothing and textile processing industry, offered a broad spectrum of innovations and technologies, from specialized software (of course AI-supported), machines for cutting, transport, sewing, welding, ironing, embroidery, sewing automation, and packaging machines. The trade fair offered comprehensive insights into the latest developments in the clothing industry.

How is the textile industry developing

It's not easy to assess the development of an industry based on a leading trade fair of this magnitude, even if you've spent three full days in the halls of Messe Frankfurt, as I did. It's easy to make claims like "beyond innovation," "fascinating," "visionary and groundbreaking." But did the trade fair actually live up to these buzzwords?

In my opinion, the trade fair largely met expectations in the fiber and fabric sector. The industry's demonstrated innovative strength in machine development was rather limited. Prominent companies like Lectra and Gerber were absent from the Texprocess segment, but Techtextil also had significant absences, most notably the American membrane specialist Gore. Innovations came primarily from Europe, Japan, and the USA. Chinese booths offered little innovation; Chinese manufacturers are focused on winning with price. My highlight at the trade fair in this regard was the booth of a Chinese manufacturer exhibiting cutting equipment with cutting technology from the 1950s.

What was striking and somewhat disconcerting was the age of the visitors, as well as the booth staff at most stands: young people were significantly outnumbered. The typical trade fair visitor was 55 years old or older.

Is the future of the manufacturing industry determined by robots?

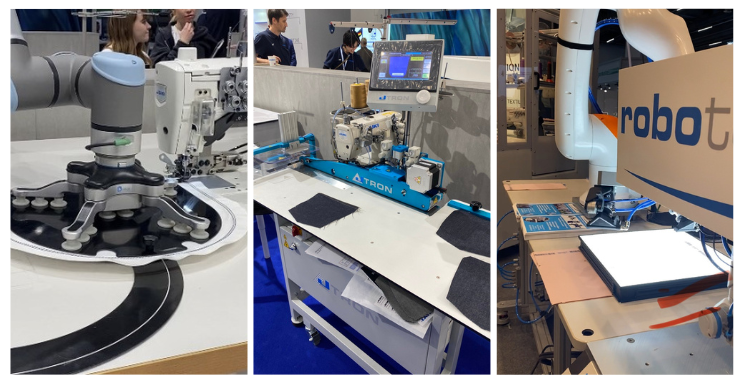

Anyone expecting a multitude of robots at Texprocess was disappointed. Robots were few and far between. At the last Texprocess, there were more robots on display, demonstrating three-dimensional seam processing. And there were proud exhibitions by universities showcasing their developments. This time, robots were only on display at a few booths. The most frequently demonstrated application was the two-dimensional feeding of a seam piece to a standard machine. The few exhibitors that showcased robotics innovations generated keen interest. This interest came primarily from the automotive sector. This sector has had years of experience in increasing efficiency through the use of robots.

The industry's automation efforts still seem to be aimed at further increasing the efficiency of mass production. The approach of intelligent digital serial production with a series run of one was not evident at any of the trade fair booths. When it comes to answering the question of where the industry wants to develop, flexibility and speed still don't seem to be a major concern.

Optimism or restraint

The booth sizes at Texprocess and Techtextil are generally manageable; there were no multi-story stands. Stands larger than 200 square meters were rather the exception at both trade fairs. In my opinion, this reflects the industry's reluctance. Even though the turnout was high—the trade fair organizers reported a 29% increase in visitors and visitors from 102 countries—the majority of the exhibitor spaces seemed rather modest.

As sewing automation continues to advance with the goal of "increasing production efficiency at high volumes," the machines are being equipped with greater intelligence. Automation is therefore becoming not only faster, but also more intelligent. Pfaff showcased a sewing machine that, with built-in cameras and AI-supported software, performs quality control and stitch length adjustments online itself. Another highlight, clearly motivated by manufacturing challenges in the automotive industry, is likely to find little use in apparel manufacturing.

A strikingly large section was dedicated to embroidery and digital printing. Art embroidery and 3D printing were the highlights; the machines are not only getting faster, but also offering more diverse design options.

From an Austrian perspective, the participation of Lenzing, Getzner, G-Loft, and Zimmer was notable. Andritz also demonstrated its focus on textile recycling and production technologies for the nonwovens sector.

Recycling and circular economy on everyone's lips

Recycling, however, was a topic at a striking number of stands. It is clear that the relevant technologies for cotton and other natural fibers are developing quite well. While the necessary technologies for synthetic fibers are known and even exist in laboratory format, industrial scaling is still lacking – at least in Europe. "Post-industrial waste" is already generally recycled, for cost reasons alone. Now, this recycling is also increasingly being used for marketing purposes. Truly revolutionary approaches that have already been scaled up to industrial scale will probably take a few more years. Perhaps we can hope for one at the next Techtextil in two years. Realistically, it will probably take a little longer.

Start-ups and innovations are primarily presenting themselves in the circular economy. Worthy of mention are RE&UP, part of the Turkish Sanko Tekstil Group, and recyc-elit from France. In the area of innovative fibers, the Belgian start-up Noosafiber is demonstrating how they turn lactic acid into fibers that are not only infinitely recyclable but also biodegradable. Also worth mentioning is the start-up SA-Dynamics, which is presenting recyclable insulation materials made from bio-based aerogel fibers. Techtextil also featured a special exhibition for textiles made from natural raw materials, with hemp as the central theme. The Canadian logistics company Unicorp Group showcased its product Vegeto Textiles, a Canadian-made thermal insulation made from hemp.

Overall, however, the topic of sustainability and circularity didn't attract nearly as much attention as expected. Rather, a sense of reluctance was evident. Sustainability wasn't a topic at many booths, and certainly not in the machinery industry. Material manufacturers may also have been cautious, so as not to promise developments that couldn't be realized in the long term.

The mood was good - there were many satisfied faces at the exhibition stands, and it seemed that the mood among the material manufacturers was better than among the machine manufacturers.

A strong sign in any case

All in all, it was nice to queue at the trade fair entrance in the morning, to meet many like-minded people, to see textile enthusiasts from many countries of the world in the packed restaurants of the city in the evening and thus to have the feeling that the industry is alive and that it is heading towards a promising future.

In any case, I'm already looking forward to the next Techtextil/Texprocess in Frankfurt in two years. But it might also make sense to visit ITMA Asia in Shanghai in fall 2024 or Singapore in 2025. Perhaps the textile and clothing industry has long since left Europe, and real innovations will take place in other parts of the world in the future.